ShmoopTube

Where Monty Python meets your 10th grade teacher.

Search Thousands of Shmoop Videos

Principles of Finance Videos 156 videos

Okay, so you want to be a company financial manager. It's basically up to you to make money for the shareholders. It would also be swell if you mad...

How is a company... born? Can it be performed via C-section? Is there a midwife present? Do its parents get in a fight over what to name it? In thi...

What is an income statement, and why do we need it in our lives? Well, let's take a look at an income statement for Year 1 of the Sauce Company, an...

Principles of Finance: Unit 1, Intro: Company Formation, Structure, and Inception: Unit Intro 43 Views

Share It!

Description:

Company Formation, Structure, and Inception: Unit Intro. Sorry, Leo DiCaprio fans—we're not going to be breaking down the plot of Inception. We're talking about a different mind-boggling concept: the creation of a new company. We'll talk about investors, equity, lines of credit, IPOs, and so much more. So you can all put away your spinning tops.

Transcript

- 00:00

finance 101 a la shmoop. unit one company formation, structure and

- 00:10

inception. unit intro. this finance course begins with a gossip rag. whether your [finance unit outlined]

- 00:17

tastes skew more toward TMZ or Weekly World News, you know for a newly started

- 00:24

company, you know with salacious gossip like who owns what? who did what to whom?

- 00:29

what's the legal structure of ownership? well if we invest a hundred bucks and

Full Transcript

- 00:34

the company does well what does that money turn into in ten years? a butterfly?

- 00:38

or hopefully a whole lot more than 100 bucks. but the most important element to

- 00:42

take away from this juicy unit is that companies are people. not just the

- 00:48

products they sell. okay so maybe companies don't slip and fall on icy

- 00:51

sidewalks and maybe they aren't eligible to win the voice, so they're not exactly [company slips on sidewalk]

- 00:57

like people. but the best companies serve products that are a direct reflection of

- 01:01

the people who founded and run them. well in this unit we'll focus on a prime

- 01:06

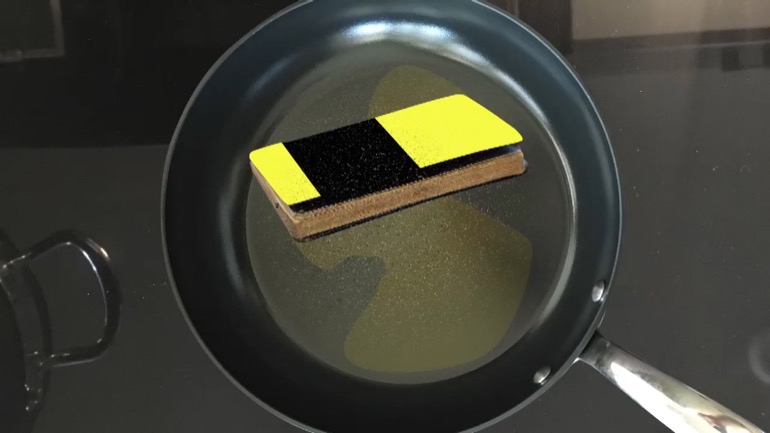

fictitious ish example the sauce company. as you'll discover the seemingly

- 01:12

innocent and tiny decisions the founders make in the formation of the sauce

- 01:17

company will have enormous wealth impact on them a few years later. you'll become

- 01:21

aware of these nuances in unit one so you know not to lose money in your own

- 01:26

financial future. we're talking about the methods in which companies get financed [wheel of fortune spins]

- 01:30

and use their financing partners to play both offense and defense in the

- 01:35

corporate games they play. private investors public investors equity debt

- 01:40

lines of credit preferred stock IPOs secondary offerings yeah well these are

- 01:46

all terms you'll digest and speak fluently soon, but for now well we'll

- 01:51

stick with the wild gossip. what are we doing here company's free

- 01:55

much like paintball and fleeting stuff oh yeah but that investment banker

- 02:00

nowhere suit IPO what a fan is felons public finally Amazon every a mature [summary listed]

- 02:08

companies not it's not you. ok by the end of this unit you should be

- 02:15

able to: identify the options you have when you form a company identify a range

- 02:20

of financing alternatives in building a company. understand what investment banks

- 02:25

and bankers do all day for a living. understand the special process of

- 02:29

fundraising called an IPO or initial public offering, and finally recognize

- 02:35

the need for reward to investors when there's risk. [objectives listed]

Related Videos

GED Social Studies 1.1 Civics and Government

What is bankruptcy? Deadbeats who can't pay their bills declare bankruptcy. Either they borrowed too much money, or the business fell apart. They t...

What's a dividend? At will, the board of directors can pay a dividend on common stock. Usually, that payout is some percentage less than 100 of ear...

How are risk and reward related? Take more risk, expect more reward. A lottery ticket might be worth a billion dollars, but if the odds are one in...